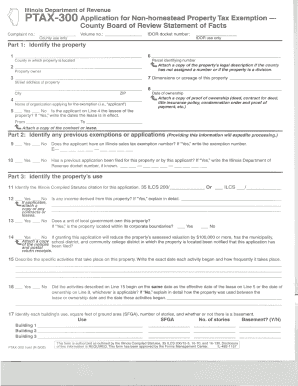

IL DoR PTAX-300 2009-2024 free printable template

Show details

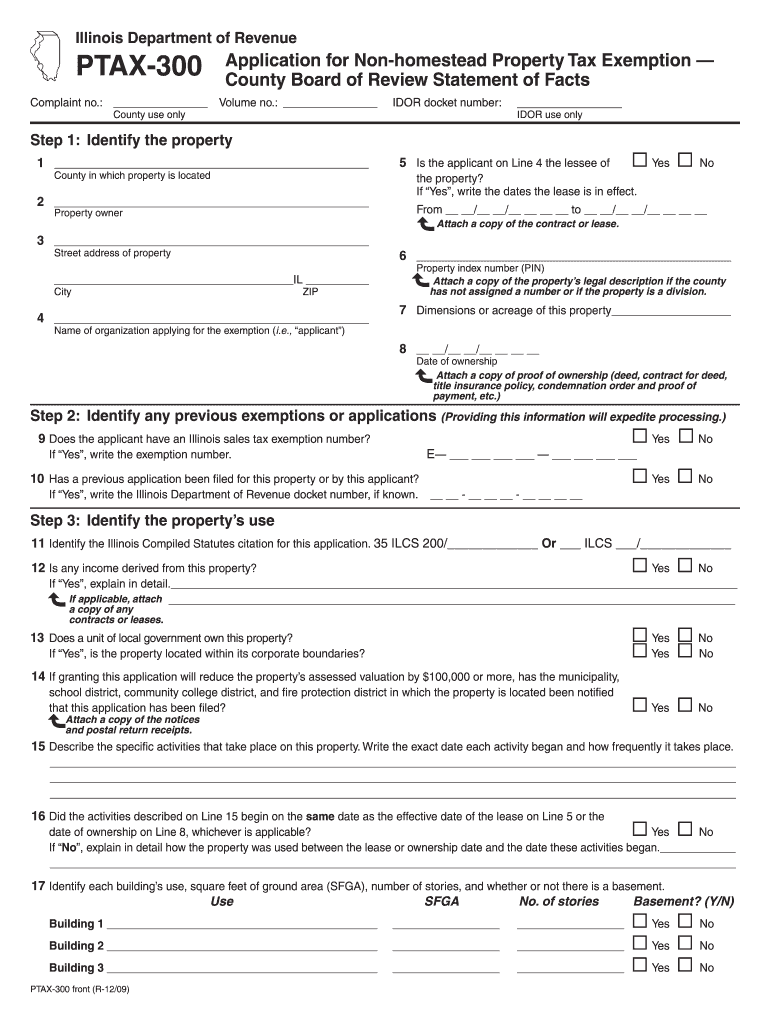

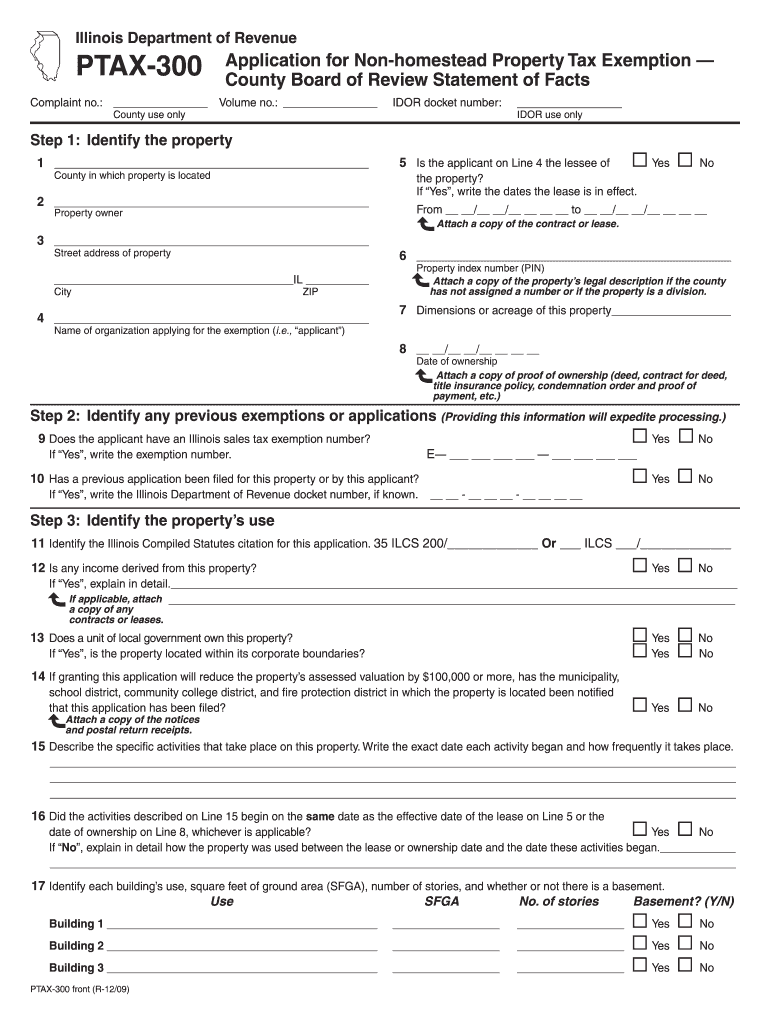

All deeds were acquired before the year for which the exemption is now being sought. Form PTAX-300 identifies which property index numbers are associated with each deed. Where is Form PTAX 300 to be filed - File the completed and notarized Form PTAX-300 with the county board of review. Note The Cook County Board of Review requires that their complaint form be filed in addition to Form PTAX-300. For a religious exemption complete Form PTAX-300-R to apply for a non-homestead exemption under 35...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ptax 300 form 2009-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ptax 300 form 2009-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ptax 300 fillable form online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ptax 300 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

IL DoR PTAX-300 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ptax 300 form 2009-2024

How to fill out ptax 300 form?

01

First, obtain a ptax 300 form from the appropriate state or local tax authority.

02

Fill in your personal information accurately, including your name, address, and social security number.

03

Provide the necessary details regarding the property for which you are filing the form, such as the property address and assessed value.

04

Enter any exemptions or deductions that may apply to your property tax liability.

05

Calculate the total amount of property tax owed based on the information provided.

06

Review the completed form for accuracy and make any necessary corrections before submitting it.

Who needs ptax 300 form?

01

Property owners who are required to pay property taxes.

02

Individuals who own real estate or land that is subject to taxation.

03

Homeowners who want to claim exemptions or deductions on their property tax liability.

Video instructions and help with filling out and completing ptax 300 fillable form

Instructions and Help about ptax tax form

Fill how to illinois ptax : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ptax 300 form?

The "PTAX 300" refers to a specific form used in the state of Illinois, USA. It is also known as the "Illinois Property Tax Appeal Board Complaint Form" or simply the "PTAB Complaint Form."

The PTAX 300 form is used by property owners in Illinois who are filing an appeal with the Illinois Property Tax Appeal Board (PTAB) to challenge the assessed value or classification of their property for property tax purposes. By completing this form, individuals provide detailed information about their property, including its location, size, use, and any specific issues they believe may affect its assessed value. The PTAB reviews these complaints and makes determinations regarding property tax assessments.

Who is required to file ptax 300 form?

PTAX 300 form is required to be filed by individuals or businesses that own or lease personal property in the state where the form is applicable. The exact requirements may vary depending on the jurisdiction. In some states, all businesses are required to file this form, while in others, only businesses that meet certain threshold values of personal property are required to file. It is advisable to check with the local tax authorities or consult a tax professional for specific requirements related to PTAX 300 filing.

How to fill out ptax 300 form?

To fill out the PTAX 300 form, follow these steps:

1. Obtain the PTAX 300 form: You can download it from the Illinois Department of Revenue website or obtain a copy from your local county treasurer's office.

2. Fill out the taxpayer's information: Provide your name, address, Social Security number or employer identification number (EIN), and contact details.

3. Fill out the property information: Enter the property's PIN (Property Index Number) or legal description, as well as the county where the property is located.

4. Specify the use of the property: Indicate whether the property is your primary residence, a second home, rental property, vacant land, or other qualifying use.

5. Complete the property assessment details: Provide the property's assessed value, the exemption amount (if applicable), the equalized assessed value (EAV), and any exemptions claimed.

6. Calculate the tax amount: Follow the instructions on the form to calculate the tax amount owed based on the property's assessed value and the applicable tax rate.

7. Sign and date the form: Sign the form to certify that the information provided is true and accurate. Ensure the date is included.

8. Submit the form: Make copies of the completed form for your records and submit the original to your local county treasurer's office. Some counties may also require a copy to be sent to the Illinois Department of Revenue.

Note: The process and requirements for filling out the PTAX 300 form may vary slightly depending on the county in Illinois. It is recommended to consult the specific instructions provided with the form and contact your local county treasurer's office for any additional guidance.

What is the purpose of ptax 300 form?

The purpose of PTAX 300 form is to report and document the transfer of real property in Illinois, USA. The form is used to report the sales transaction and calculate the amount of real estate transfer tax owed to the county or municipality where the property is located. It includes details such as the parties involved, property description, purchase price, and other relevant information. The form must be filed with the county recorder or registrar of titles office to complete the transfer of property ownership.

What information must be reported on ptax 300 form?

The PTAX 300 form is used for reporting real estate transactions in Illinois. The information that must be reported on the PTAX 300 form includes:

1. Buyer and Seller Information: The names, addresses, and contact information of both the buyer and seller of the property.

2. Property Description: The address and legal description of the property being transferred.

3. Sales Price: The total sales price or consideration paid for the property.

4. Financing Details: Any financing involved in the transaction, including the amount of the loan, the name of the lender, and any other relevant details.

5. Exemptions and Adjustments: Any exemptions or adjustments to the sales price, such as exemptions for first-time homebuyers or senior citizens.

6. Prorations and Credits: Any prorations or credits that may apply to the transaction, such as prorated property taxes or prepaid assessments.

7. Signatures: The form must be signed and dated by both the buyer and the seller.

It is important to note that the specific requirements for the PTAX 300 form may vary by county or municipality within Illinois. Therefore, it is advisable to consult the specific instructions provided by the local taxing authority for accurate reporting.

What is the penalty for the late filing of ptax 300 form?

The penalty for the late filing of PTAX 300 form can vary depending on the specific regulations and guidelines of the relevant jurisdiction. In some cases, there may be a flat penalty fee imposed for each day of delay, while in others it may be a percentage of the taxes due. It is important to consult the specific tax authorities or seek professional advice to determine the exact penalty for late filing of PTAX 300 form.

How can I send ptax 300 fillable form for eSignature?

Once you are ready to share your ptax 300 form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in how to illinois form ptax 300?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your ptax 300 fillable to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for the form ptax 300 in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Fill out your ptax 300 form 2009-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Illinois Form Ptax 300 is not the form you're looking for?Search for another form here.

Keywords relevant to il ptax form

Related to illinois ptax 300

If you believe that this page should be taken down, please follow our DMCA take down process

here

.